What Are The 7 Streams Of Income?

Welcome to the exciting world of multiple income streams! In a rapidly changing economy, relying solely on one source of income can be risky. That’s where the concept of “the 7 streams of income” comes in.

Whether you’re an aspiring entrepreneur or simply looking to diversify your earnings, understanding these diverse avenues for generating wealth is key. From passive investments to side hustles and everything in between, we’ll explore how each stream works and unleash its untapped potential. Get ready to unlock financial freedom as we dive into what it truly means to create a life filled with abundance and prosperity!

Table of Contents

Introduction to the 7 Streams of Income

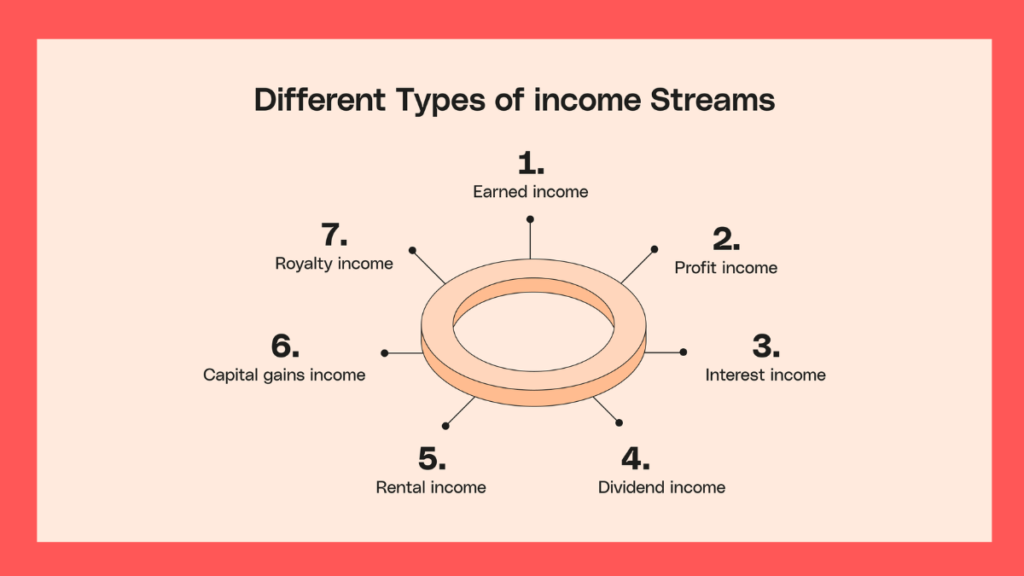

There are 7 streams of income, each with its own set of benefits and drawbacks. They are:

- Active Income: This is the most common type of income, earned through working and trading your time for money. The benefits of active income include having a predictable stream of income and being able to directly control your earnings. The main drawback is that it can be difficult to earn a high level of active income without working long hours or taking on risky jobs.

- Passive Income: This type of income is earned without having to actively work for it. The most common forms of passive income are interest from investments, rental income from property, and royalties from intellectual property such as patents or copyrights. The main benefit of passive income is that it can provide a steady stream of earnings even when you are not actively working. The main drawback is that it can take a significant amount of time and effort to generate enough passive income to live off of.

- Portfolio Income: This type of income is generated by investing in a portfolio of assets such as stocks, bonds, and real estate. The benefits of portfolio income include the potential for high returns and the ability to diversify your earnings sources. The main drawback is that it can be difficult to generate consistent portfolio income, especially in volatile markets.

- Social Security Income: This type of income comes from the government’s Social Security program, which provides monthly payments to retirees and disabled people who meet certain eligibility requirements. The main benefit of Social Security income is that it is guaranteed and can provide a steady stream of funds even if you are no longer working. The main drawback is that Social Security benefits are usually quite low compared to other sources of income.

- Retirement Income: This type of income comes from retirement savings such as 401(k)s, IRAs, annuities, and pensions. The main benefit of retirement income is that it can provide a steady stream of funds in retirement without having to actively work for it. The main drawback is that the amount received can be limited by the amount saved in the account and may not be enough to live comfortably on its own.

- Business Income: This type of income comes from owning and operating a business. The benefits of business income include having control over your earnings potential as well as potential tax advantages if structured properly. The main drawback is that businesses require significant capital investment and a lot of hard work to become successful, making them risky investments for many people.

- Capital Gains: This type of income comes from selling assets such as stocks or real estate for more than their purchase price. The main benefit of capital gains is that they can provide large amounts of income in a short period of time. The main drawback is that the gains are usually taxed at a higher rate than other sources of income and can be difficult to predict.

Overall, each stream of income has its own unique benefits and drawbacks. It is important to consider all of them when deciding which stream of income is right for you.

Types of Streams

There are three primary types of streams of income: active, passive, and portfolio.

- Active income is money that you earn by working. This could be a salary from a job, wages from freelance work, or tips from customers if you own a business. If you work for someone else, they are responsible for paying you active income. If you work for yourself, you must generate this income through your own efforts.

- Passive income is earnings derived from a rental property, limited partnership, or other enterprise in which a person is not actively involved. As with active income, passive income is usually taxable. However, it is often possible to deduct losses on passive investments against other forms of taxable income.

- Portfolio income is money earned from investing, such as dividends from stocks or interest from bonds. Portfolio income is considered to be passive because it represents a return on investment rather than direct labor. Although portfolio income is generally taxed at a lower rate than active or passive income, it can become subject to higher taxes if it constitutes the majority of your total earnings.

In summary, there are three types of streams of income: active, passive, and portfolio. Active income is money earned through direct labor; passive income is derived from investments; and portfolio income is earned from investment activity.

Pros and Cons of Each Stream

There are four streams of income: linear, residual, portfolio, and passive. Each has its own set of pros and cons that you should consider before choosing which is right for you.

- Linear income:- is the most common type of income. It’s what you get from a job – a regular paycheck for your time and effort. The main pro of linear income is that it’s predictable and reliable. The main con is that it can be very difficult to increase your earnings – you can only make more money by working more hours or getting a promotion.

- Residual income:- is often seen as the best type of income because it gives you the potential to earn money even when you’re not working. The main pro of residual income is that it can provide a great deal of financial security. The main con is that it can be quite unpredictable – your earnings may fluctuate greatly from month to month or year to year.

- Portfolio income:- is earned through investments such as stocks, bonds, and real estate. The main pro of portfolio income is that it has the potential to grow significantly over time. The main con is that it can be very volatile – your earnings may go up or down a lot in a short period of time.

- Passive income:- is any type of income that doesn’t require active work on your part. The most common examples are royalties from books or music, rent from property, or dividends from stocks. The main pro of passive income is that it can provide a steady income stream without requiring much effort. The main con is that it can take a while to get established and start earning money.

Examples of Each Stream

There are four primary streams of income: earned, portfolio, passive, and residual. Here are examples of each:

- Earned Income: This is the money you earn by working. Your paycheck is considered earned income. If you’re self-employed, your earnings are also considered earned income.

- Portfolio Income: This is income earned through investments, such as interest from savings accounts, dividends from stocks, or capital gains from the sale of assets.

- Passive Income: This is money you earn without actively working for it. Examples of passive income include rental income from property you own, royalties from books or other intellectual property, and interest from bonds.

- Residual Income: This is ongoing income that continues to be generated even after you’ve stopped working. For example, if you create a blog and sell advertising on it, the blog will continue to generate revenue even after you stop writing new posts. Another example is if you create a YouTube channel and generate revenue through ads and sponsorships, your channel will continue to make money even if you don’t upload new videos regularly. These are four different streams of income that can help you create multiple sources of income and financial security.

Strategies for Maximizing Income from Each Stream

There are many strategies that can be used to maximize income from each stream. Here are a few of the most effective:

- Diversify your income streams:- Don’t put all your eggs in one basket. By diversifying your income sources, you’ll be less likely to experience a major financial setback if one stream dries up.

- Automate as much as possible:- Use technology to your advantage by automating payments and other tasks related to your income streams. This will free up your time so you can focus on other things.

- Keep track of your expenses:- Knowing where your money is going is critical for maximizing your income. Make sure to track all of your expenses so you can see where you can cut back or make adjustments.

- Invest in yourself:- Continually invest in yourself and your skill set so you can increase your earning potential over time. This could include taking courses, attending workshops, or reading books on business and personal development.

- Utilize tax breaks and other incentives:- Take advantage of tax breaks and other financial incentives related to your income streams. There could be opportunities you’re not taking advantage of that could significantly boost your earnings.

- Network and collaborate with others:- Make connections and reach out to potential collaborators for joint ventures or new projects. This can help you generate more income by expanding your reach and tapping into different markets or customer bases.

- Take advantage of compound interest:- Investments can help you generate passive income over time, and taking advantage of compound interest can be a great way to maximize your earnings. Consider investing part of your income in stocks, bonds, or other investments to get the most out of your money.

How to Balance Your Multiple Streams of Income?

There are a few key things to remember when trying to balance your multiple streams of income.

- First, don’t put all your eggs in one basket. Diversify your sources of income so that if one stream dries up, you have others to fall back on.

- Second, remember that some streams will be more reliable than others. Try to have a mix of stable and less stable sources of income to even out the fluctuations. Stay organized and keep track of where each stream is coming from and how much money you’re making from it. This will help you keep on top of things and make sure that everything is balanced.

- Finally, don’t forget to factor in taxes when trying to balance your multiple streams of income. Make sure you’re setting aside money for taxes and other expenses so that you can make sure all your streams are accounted for when tax time comes around.

Conclusion

The seven streams of income are a great way to diversify your income and create multiple sources of financial security. With the right planning, you can create an extensive portfolio that includes investments in stocks, mutual funds, real estate, businesses, and even passive income opportunities like royalties or dividends.

It’s important to remember that all investments come with risks so it is best to do research before investing any money. Taking the time now to build up your streams of income could be one of the most rewarding decisions you ever make for both yourself and your family!