You’ve saved ₹2 lakh. Your colleague swears by monthly SIPs, but your friend just made a killing with a lumpsum investment. Now you’re stuck—should you invest it all at once or spread it out? This confusion costs Indians crores in missed opportunities every year. Here’s the truth: there’s no one-size-fits-all answer, but by the end of this article, you’ll know exactly which strategy matches your money goals, risk appetite, and current situation.

Understanding the Basics First

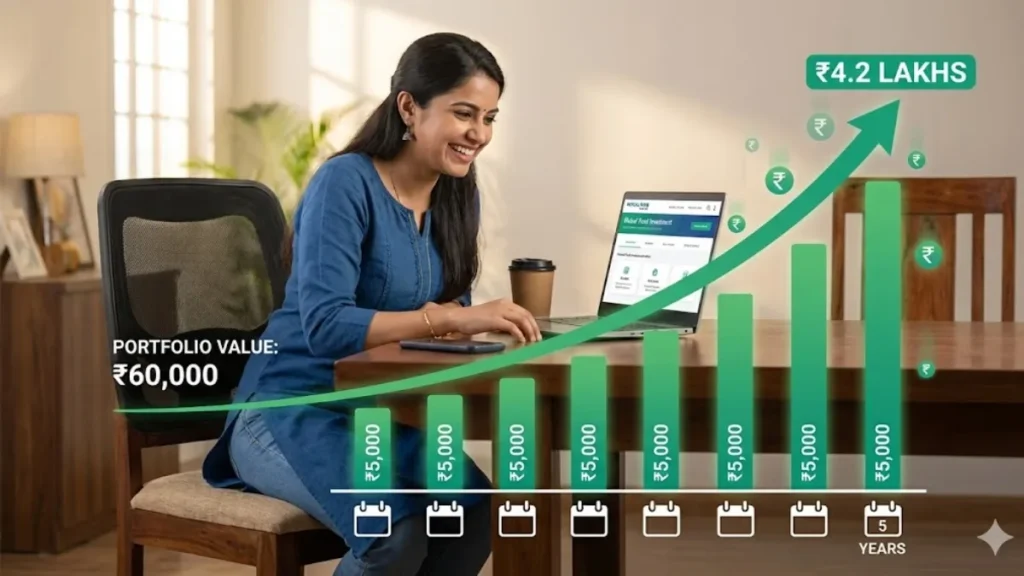

Before we dive into SIP vs Lumpsum, let’s get crystal clear on what we’re comparing. A Systematic Investment Plan (SIP) means investing a fixed amount regularly—like ₹5,000 every month—into mutual funds. You can learn everything about The Complete Guide to SIP in our detailed guide.

Lumpsum investment means putting a large amount in one go—like investing ₹2 lakh today itself. It’s straightforward but requires different thinking. For a complete breakdown, check out our guide on Lump Sum Investment: Complete Guide for Indian Investors.

Both strategies invest in the same mutual funds. The difference? Timing and amount.

SIP vs Lumpsum: The Real Comparison

Let’s cut through the noise. Here’s what actually matters when you’re choosing between these two:

Market Timing Risk is where most investors mess up. Lumpsum demands perfect timing—invest at a market peak, and you’ll watch your money bleed. SIP removes this pressure completely. You invest regardless of market ups and downs.

Rupee Cost Averaging sounds fancy but works simply. When markets fall, your ₹5,000 SIP buys more units. When markets rise, you buy fewer units. Over time, your average cost balances out. Lumpsum doesn’t give you this cushion.

Capital requirement separates these strategies sharply. SIP works with ₹500 per month. Lumpsum needs significant upfront capital—₹50,000, ₹2 lakh, or more.

Now here’s the comparison table that actually helps you decide:

| Factor | SIP | Lumpsum |

|---|---|---|

| Minimum Amount | ₹500/month | ₹5,000+ (one-time) |

| Market Risk | Low (averaged out) | High (timing matters) |

| Rupee Cost Averaging | Yes | No |

| Discipline Required | Forces habit | Needs willpower |

| Best Market Condition | Any time | Market dips/corrections |

| Returns in Bull Market | Good | Excellent |

| Returns in Volatile Market | Excellent | Risky |

| Ideal For | Salary earners | Windfall receivers |

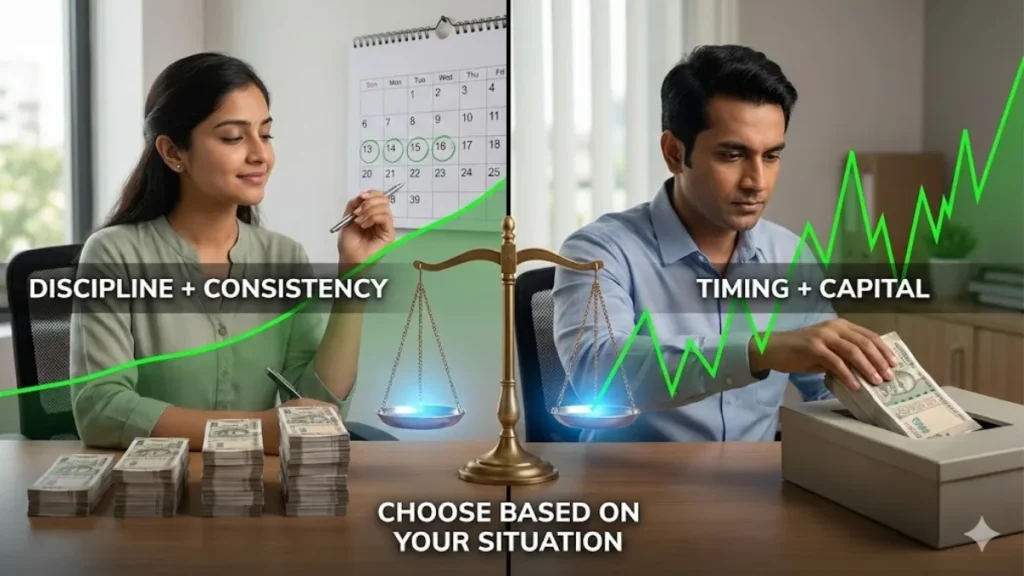

This table reveals something crucial: SIP vs Lumpsum isn’t about which is better—it’s about which fits your situation.

When SIP Beats Lumpsum Every Time

You’re earning ₹50,000 per month. After expenses, you save ₹10,000. Should you wait 10 months to collect ₹1 lakh for lumpsum? Hell no.

Start a ₹10,000 SIP today. Every month you delay costs you potential returns. SIP works brilliantly when:

Your income is regular. Salaried professionals, freelancers with monthly retainers, business owners with steady cash flow—SIP converts your income into wealth systematically.

You’re new to investing. Made your first investment? Watching market swings will scare you. SIP removes the emotional rollercoaster. You invest mechanically, without panic or greed.

Markets are at all-time highs. Everyone’s talking about market peaks? Perfect SIP time. You’ll average your costs across multiple market levels over the next 5-10 years.

Your goal is 10+ years away. Retirement, child’s education, buying a house—long-term goals love SIPs. You get compounding plus rupee cost averaging. Double benefit.

Real example: Rajesh started a ₹5,000 SIP in 2015. By 2024, he invested ₹5.4 lakh. His portfolio? Worth ₹9.8 lakh. He never timed the market, never panicked during crashes, just continued his SIP.

When Lumpsum Crushes SIP

Your company gave you a ₹5 lakh bonus. Or your father transferred ₹10 lakh from a matured FD. This money isn’t coming monthly—it’s here now. Lumpsum makes perfect sense when:

You receive windfall money. Bonus, inheritance, maturity proceeds, property sale—invest it immediately. Don’t let it rot in a savings account earning 3%.

Markets have corrected 15-20%. March 2020 COVID crash, 2008 financial crisis—these are lumpsum moments. When everyone’s selling, you’re buying at discount prices.

You’re an experienced investor. You understand market cycles, you don’t panic during 10% drops, you have other investments running—lumpsum gives you maximum exposure to potential upsides.

Your goal is 3-5 years away. Shorter timeframes need capital to work harder. Lumpsum puts your entire amount to work from day one. Every day matters for compounding.

Real example: Priya received ₹8 lakh from selling her old flat in March 2020 when markets crashed 30%. She invested it all in an equity mutual fund. By 2024, it grew to ₹18 lakh. Timing met opportunity.

The Smart Play: Combine Both Strategies

Here’s what smart investors actually do—they don’t choose between SIP vs Lumpsum. They use both.

Your strategy: Start a monthly SIP with your regular income. When you get bonus, wedding gifts, or any windfall—make a lumpsum investment.

Example: You run a ₹8,000 monthly SIP. You receive ₹1.5 lakh Diwali bonus. Don’t stop the SIP. Add the bonus as a lumpsum in the same or different mutual fund scheme. Your SIP continues building discipline. Your lumpsum captures immediate market opportunities.

This hybrid approach gives you consistency plus flexibility. You’re always invested, always growing wealth.

Lump sum and systematic investment plans have their own advantages and disadvantages, which have been well highlighted by AMFI.

Critical Factors Before You Decide

Your financial goal’s timeline decides everything. Buying a car in 2 years? Lumpsum might work if you have the capital. Retirement in 25 years? SIP all the way.

Risk appetite isn’t about how brave you feel. It’s about how much loss you can absorb without derailing your life. Can you watch ₹1 lakh become ₹70,000 temporarily? Lumpsum is fine. Can’t sleep thinking about losses? Stick to SIP.

Available capital right now is the practical decider. You don’t have ₹5 lakh sitting idle? Then SIP vs Lumpsum isn’t even a debate. SIP is your only realistic option.

Mistakes That Kill Returns

Investors stop SIPs during market crashes. Terrible move. Market crashes are when your SIP buys units at discounts. Stopping it is like refusing to buy vegetables when they’re 50% off.

Waiting for the “perfect time” for lumpsum never works. Markets don’t send you invitations. By the time you’re confident, the opportunity has passed.

Copying someone else’s strategy without understanding your own situation destroys wealth. Your colleague’s lumpsum success happened because of HIS circumstances, not because lumpsum is universally better.

FAQ: Your SIP vs Lumpsum Questions Answered

Which gives higher returns—SIP or Lumpsum?

If you invest lumpsum at a market bottom, it wins. But nobody can time the market consistently. Over 10+ years, SIP delivers comparable returns with far less stress and risk.

Can I convert my SIP to lumpsum later?

You can’t “convert” but you can stop your SIP and invest remaining money as lumpsum. However, this defeats the purpose of disciplined investing. Better to keep SIP running and add lumpsum separately.

Should I start SIP when the market is high?

Absolutely yes. SIP works in all market conditions. When markets are high, you buy fewer units. When they fall, you buy more. This averaging is the entire point of SIP.

How much should I invest in SIP vs Lumpsum?

SIP: 15-20% of your monthly income. Lumpsum: Any windfall money after keeping 6 months emergency fund aside. Don’t invest money you’ll need in the next 3 years.

Can I do both SIP and Lumpsum in the same fund?

Yes, absolutely. Most mutual funds allow both. Your SIP continues regularly while you can add lumpsum investments anytime. They all get added to the same fund, giving you flexibility.

Which is better for beginners?

SIP is perfect for beginners. It removes the pressure of market timing, builds investing discipline, and works with small amounts. Start with ₹1,000-2,000 monthly if you’re just beginning.

Your Next Move

The SIP vs Lumpsum debate ends here. You don’t need to pick sides. Your income structure, capital availability, and goals will decide for you.

Got regular salary? Start your SIP today—even ₹500 works. Received a bonus or lump sum? Invest it immediately, don’t let it sit idle. Have both happening? Use the hybrid strategy and capture the best of both worlds.

Stop overthinking. Stop waiting for the “right time.” The market rewards action, not analysis paralysis. Your future self will thank you for starting today, not for finding the perfect strategy.

For everything else about building wealth through mutual funds, dive into our Mutual Funds in India Complete Guide and start your investment journey now.

Conclusion

The SIP vs Lumpsum debate ends here—your income structure, capital availability, and goals decide for you, not some expert’s opinion. Stop overthinking, stop waiting for the “right time,” and start investing today because the market rewards action, not analysis paralysis. Your future self will thank you for starting now, not for finding the perfect strategy.

Disclaimer: This article is for educational purposes only and should not be considered as financial advice. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Consult with a SEBI-registered financial advisor for personalized investment guidance.