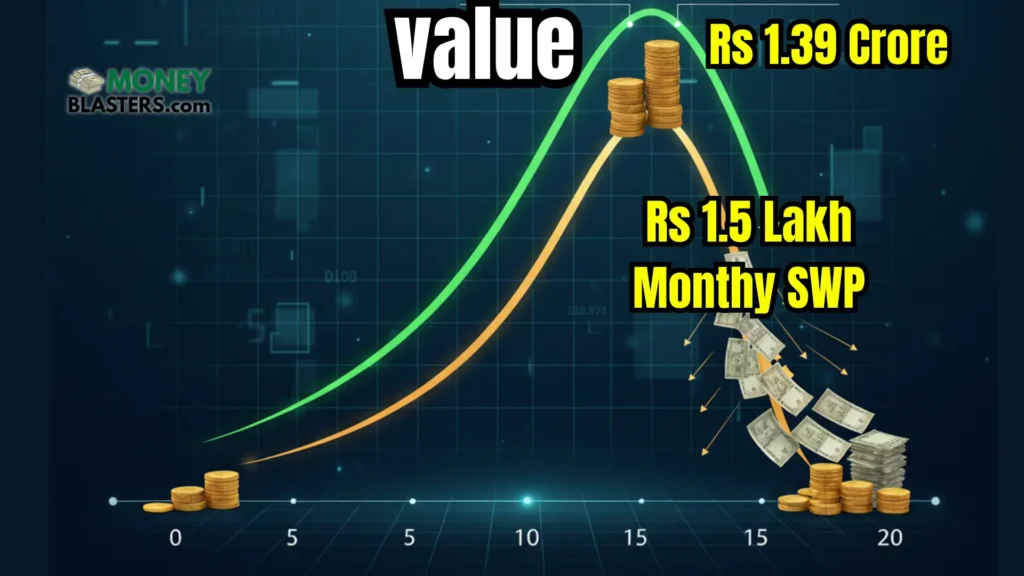

💡 Start with ₹5,000 SIP, grow your wealth for 20 years, and then withdraw ₹1.5 Lakh monthly via SWP without depleting your corpus. Learn how this proven SIP & SWP strategy creates lifetime income.

Most people believe that retirement planning requires huge capital. But what if I told you that just ₹5,000 per month can make you financially independent for life?

This article reveals a tested and verified SIP & SWP strategy that helps you build long-term wealth and ensures you never run out of income — even after retirement.

👉 By the end of this post, you’ll know exactly how to:

- Turn ₹5,000/month into ₹1.39 crore in 20 years.

- Withdraw ₹1.5 lakh every month for life.

- Keep your investment corpus growing simultaneously.

What Is SIP (Systematic Investment Plan)?

A SIP (Systematic Investment Plan) is a disciplined way of investing small amounts regularly in mutual funds. It leverages compounding and rupee cost averaging, ensuring you don’t need to time the market.

For instance:

- Start with ₹5,000/month.

- Increase by 10% every year (Step-Up SIP).

- Continue for 20 years.

Your total invested amount: ₹23.16 Lakh

Final corpus (at 12% CAGR): ₹1.39 Crore

SWP: Turning Corpus into Lifetime Income

Once you build a strong corpus, start an SWP (Systematic Withdrawal Plan).

In this plan, your corpus remains invested, and you withdraw a fixed monthly amount.

Example:

- Corpus: ₹1.39 Crore

- Monthly SWP: ₹1.50 Lakh

- Annual withdrawal: ₹18 Lakh

- Average return: 12%

Even after withdrawals, your corpus continues to grow due to compounding.

How SIP + SWP Work Together

| Step | Action | Duration | Result |

|---|---|---|---|

| 1 | Start SIP of ₹5,000/month | 20 Years | ₹1.39 Crore Corpus |

| 2 | Switch to SWP | Next 20+ Years | ₹1.5 Lakh Monthly Income |

| 3 | Corpus Growth | Continuous | Corpus Increases Further |

This cycle ensures financial independence — your money works for you continuously.

Why This Strategy Never Fails

- Power of Compounding: Long-term SIP ensures exponential growth.

- Step-Up Benefit: Incremental SIP boosts total corpus significantly.

- SWP Discipline: Monthly withdrawals maintain consistency.

- Tax Efficiency: Long-term capital gains from equity mutual funds are tax-friendly.

- Corpus Longevity: Withdrawals are smaller than annual growth, so the corpus never depletes.

The Mathematics Behind ₹5,000 SIP

| Parameter | Value |

|---|---|

| Monthly SIP | ₹5,000 |

| Annual Step-up | 10% |

| Tenure | 20 Years |

| Expected Return | 12% CAGR |

| Total Invested | ₹23.16 Lakh |

| Final Corpus | ₹1.39 Crore |

This simple calculation shows how discipline + time + compounding = financial freedom.

The Psychology of SIP & SWP

- SIP builds wealth habits.

- SWP builds income stability.

- Together, they build financial freedom.

This plan is suitable for:

- Salaried individuals

- Self-employed professionals

- Anyone looking for retirement income

10 Most Asked Questions (FAQs)

- What is the minimum SIP amount to start?

You can start SIP with as little as ₹500, but ₹5,000/month gives better long-term results. - Can SWP be started anytime?

Yes, once you have a stable corpus, you can begin SWP anytime. - Is SIP better than a fixed deposit?

Absolutely. SIP offers higher returns and inflation-adjusted growth. - Is SWP safe for retirement income?

Yes, if you maintain a balanced portfolio with growth and stability. - What if the market falls during SWP?

A diversified portfolio ensures stability during short-term volatility. - How long can the SWP income continue?

Indefinitely — as long as your annual withdrawals are less than annual returns. - Is there tax on SIP or SWP?

SIP gains are taxed under LTCG; SWP withdrawals attract minimal tax depending on duration. - Can SIPs be paused or increased?

Yes, you can modify SIP anytime with your fund provider. - Which mutual funds are ideal for this strategy?

Large-cap, balanced advantage, and index funds are great for SIP–SWP combo. - Can I get a customized SIP–SWP plan?

Yes, you can contact a certified AMFI-registered distributor for a personalized plan.

Conclusion

Starting with just ₹5,000 per month can set you on the path to lifetime wealth and monthly income.

The SIP & SWP strategy proves that financial freedom isn’t about how much you earn — it’s about how consistently you invest.

Start your SIP today and let compounding do the magic — so you can live stress-free tomorrow.

Disclaimer

This content is for educational purposes only and does not constitute any investment, buy, or sell advice. Please consult your financial advisor before investing.

🚀 Start Your SIP Journey Today!

If you want to begin your financial journey the right way, get in touch with me. I can help you create a personalized SIP plan tailored to your financial goals and needs.

👉 Contact Me NowYour Trusted Investment Partner

I am Abhishek Chouhan — an AMFI-Registered Distributor (ARN 165168) with over 10+ years of experience in investment and financial awareness. My mission is to help Indian investors achieve their financial goals through proper guidance and discipline.

Hi moneyblasters.com,

You’re providing very useful content for your readers.

We assist website owners and bloggers to get real, targeted traffic and convert visitors into potential clients. Using the same method that reached you — posting focused blog comments and contact form messages in your niche and location — our chatbot engages these visitors automatically to capture leads efficiently.

As a special offer, if you purchase our chatbot service (normally $69, now $49), simply tell us your website, and we will take care of the comment and contact form service for you. We’ll create 1000 targeted comments or submissions to bring visitors interested in your niche and location — worldwide.

We provide chatbots for many niches: general chatbots, real estate, dental, education, hotels & tourism, bars, cafés, automotive, and more.

See the full system here: https://chatbotforleads.blogspot.com/ — it shows precisely how the traffic and lead generation works in action.

Thank you for your time, and I hope this information is useful for you and your website visitors.