Most Indians work hard, save money, and still feel that financially they are stuck at the same place year after year. Salary badhti hai, expenses bhi badh jaate hain, aur savings ka real growth kahin dikhai nahi deta.

The real problem is not income — the real problem is how money is being invested.

This guide will show you how mutual funds actually work in India, and how you can use them practically to build real long-term wealth instead of just saving money.

TL;DR – Quick Summary

- Mutual funds are the most practical way for Indians to build long-term wealth and beat inflation.

- SIP is the best method to invest in mutual funds because it builds discipline and reduces market timing risk.

- Equity mutual funds are ideal for long-term growth, while debt and hybrid funds provide stability.

- Most investors fail not because of wrong funds, but because of panic, lack of patience, and poor strategy.

- Consistent investing, proper fund selection, and staying invested matter more than trying to predict the market.

Table of Contents

What is Mutual Fund? (Simple Indian Explanation)

In simple words, mutual funds are a way where many people invest their money together, and a professional fund manager invests that money on their behalf in the stock market, bonds, or other financial instruments.

Instead of you personally buying 20 different shares or bonds, you invest in one mutual fund, and that fund already holds a diversified portfolio.

Think of it like this:

You and 10,000 other investors pool money. A professional expert manages that money and tries to grow it for everyone.

That’s the core idea behind mutual funds in India.

You don’t need to:

- Track markets daily

- Pick individual stocks

- Time the market

Your job is simple:

- Choose the right mutual fund

- Invest regularly

- Stay invested for long term

How Mutual Funds Work in India

To understand mutual funds practically, you need to know 4 basic players:

1. Investor (You)

You invest money through SIP or lump sum.

2. AMC (Asset Management Company)

Companies like SBI, HDFC, ICICI, Nippon manage mutual funds.

3. Fund Manager

A professional who decides where your money will be invested.

4. Market

Stocks, bonds, government securities, etc.

The Flow:

Investor → AMC → Fund Manager → Market → Returns

You get units of the fund.

The value of each unit is called NAV (Net Asset Value).

If NAV increases, your investment grows.

If NAV falls, your investment value falls.

This is why mutual funds are market-linked, not fixed like FD.

Why Mutual Funds Became Popular in India

Earlier, most Indians used only:

- Fixed Deposits

- Recurring Deposits

- Gold

- Real estate

But the problem was simple:

Inflation was beating returns.

Example:

If FD gives 6% and inflation is 7%,

your real return is actually negative.

This is where mutual funds in India changed the game:

- Higher long-term returns

- Beat inflation

- Small starting amount (₹500 SIP)

- Professionally managed

That’s why today even middle-class salaried people prefer mutual funds over FDs for long-term goals.

Types of Mutual Funds in India

This is where most beginners get confused.

So let’s break it in a practical way, not textbook way.

Equity Mutual Funds

Equity mutual funds invest mainly in stocks (shares) of companies.

These are best for:

- Long-term wealth creation

- 5+ years investment horizon

- Higher risk, higher return

Sub-types you should know:

Large Cap Funds

Invest in big, stable companies like Reliance, TCS, Infosys.

Mid Cap Funds

Medium-sized companies with growth potential.

Small Cap Funds

Small companies, high growth, high risk.

Flexi Cap Funds

Fund manager can invest in any size company.

Reality check:

Equity mutual funds can fall in short term, but historically they give the best long-term returns in India.

Debt Mutual Funds

Debt mutual funds invest in:

- Government bonds

- Corporate bonds

- Treasury bills

These are for:

- Capital protection

- Lower risk

- Stable returns

Examples:

- Liquid funds

- Short-term debt funds

- Corporate bond funds

Debt funds are used when:

- You need money in 1–3 years

- You don’t want high volatility

Hybrid Mutual Funds

Hybrid funds invest in both equity and debt.

Best for:

- Beginners

- Moderate risk investors

- Balanced approach

These funds give:

- Growth from equity

- Stability from debt

Perfect for people who:

Want better returns than FD but don’t want full stock market risk.

Other Important Mutual Funds

ELSS (Tax Saving Funds)

- Equity funds with 3-year lock-in

- Eligible for Section 80C

- Dual benefit: tax saving + wealth creation

Index Funds

- Copy Nifty 50 or Sensex

- Low cost

- Passive investing

ETFs

- Traded like shares

- Track index or gold

- Slightly advanced product

The Real Meaning of Investing in Mutual Funds

Most people think:

Mutual funds = quick money

Wrong.

The real meaning is:

Mutual funds = disciplined long-term wealth system

It is not about:

- Daily profit

- Trading

- Guessing market

It is about:

- Regular investing

- Time in the market

- Compounding

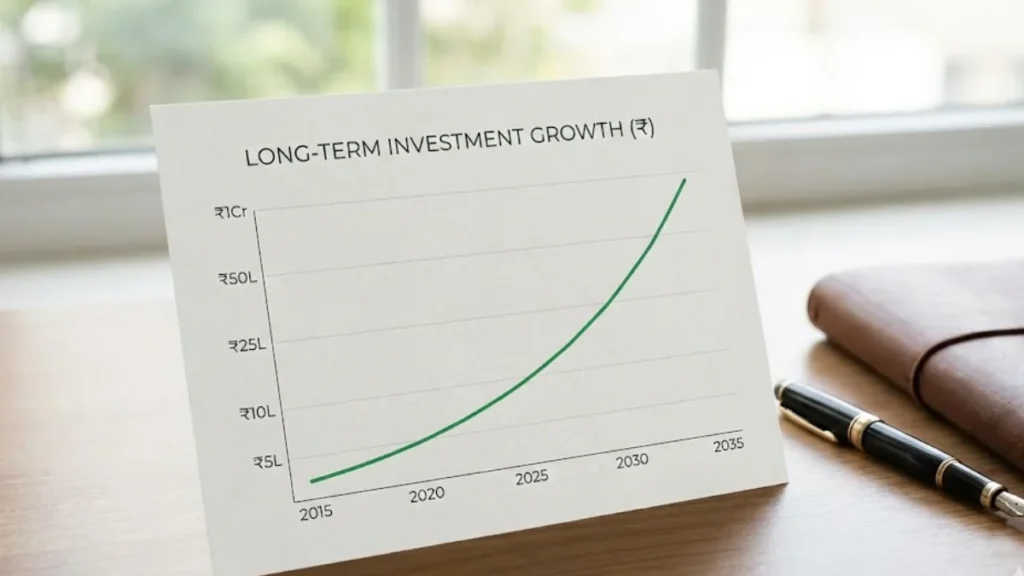

This is why people who stay invested in mutual funds for 10–15 years usually outperform:

- FD investors

- Gold investors

- Random stock pickers

The Biggest Advantage of Mutual Funds (Most People Miss This)

The real power of mutual funds is not returns.

The real power is behaviour management.

Mutual funds force you to:

- Invest regularly

- Ignore market noise

- Think long-term

- Avoid emotional decisions

In simple words:

Mutual funds protect you from your own mistakes.

And in investing, your biggest enemy is not the market — it is your own behaviour.

Are Mutual Funds Safe in India?

This is the most common question.

Answer:

Mutual funds are safe as a structure, but returns are not guaranteed.

Meaning:

- Your money is regulated by SEBI

- AMC cannot run away with your money

- But market ups and downs will affect returns

So safety depends on:

- Time horizon

- Fund selection

- Your patience

If you invest for short term and panic, mutual funds feel risky.

If you invest long term and stay disciplined, mutual funds become powerful.

The Practical Truth About Mutual Funds

Let’s be honest.

Mutual funds are not magic.

They will not make you rich in 6 months.

But they will:

- Make you financially independent

- Beat inflation

- Build real wealth

- Give mental peace

If and only if:

You treat mutual funds as a system, not a shortcut.

Key takeaway so far:

Mutual funds are not about timing the market.

They are about time in the market.

SIP vs Lumpsum Investment in Mutual Funds

This is the first real decision every investor faces.

“Should I invest monthly through SIP or invest a big amount at once?”

And honestly, 90% Indians already know the answer but still overthink it.

Before starting a SIP, it is always better to use a SIP calculator to understand how much wealth you can realistically build over time.

What is SIP in Mutual Funds?

SIP (Systematic Investment Plan) means:

You invest a fixed amount every month in a mutual fund.

₹500, ₹1,000, ₹5,000 — whatever suits your income.

SIP is perfect for:

- Salaried people

- Business owners with regular cash flow

- Beginners

- Long-term investors

The biggest advantage of SIP is not returns.

The biggest advantage is discipline.

SIP forces you to:

- Invest regularly

- Ignore market noise

- Average your cost

- Stay invested long-term

That’s why SIP is considered the best way to invest in mutual funds in India.

What is Lumpsum Investment?

Lumpsum means:

You invest a big amount in one go.

For example:

₹2 lakh, ₹5 lakh, ₹10 lakh at once.

Lumpsum works best when:

- You already have surplus cash

- Market is reasonably low

- You have long-term horizon

- You understand market cycles

Lumpsum gives higher returns only if timing is right.

But timing the market consistently is extremely difficult.

SIP vs Lumpsum – The Practical Truth

Here is the honest Indian reality:

| Situation | Better Option |

|---|---|

| Regular salary | SIP |

| Beginner investor | SIP |

| Market volatile | SIP |

| One-time bonus/inheritance | Lumpsum |

| Market crash | Lumpsum (partial) |

Conclusion:

For most people, SIP wins.

Not because it gives more returns, but because it gives better behaviour.

We have written a detailed article explaining SIP vs Lumpsum, so if you want to understand it in depth then definitely read this article.

Benefits of Investing in Mutual Funds

Let’s remove marketing language and talk real benefits.

1. Professional Management

Your money is managed by full-time experts.

Not by tips, not by Telegram, not by YouTube.

2. Diversification

One fund invests in 20–50 companies.

Your risk automatically spreads.

3. Low Starting Amount

You can start mutual funds with ₹500 SIP.

No other serious investment allows this.

4. Liquidity

You can redeem anytime (except ELSS lock-in).

5. Inflation Beating Potential

Over long term, mutual funds beat:

- FD

- RD

- Savings account

- Gold (mostly)

This is why mutual funds are the backbone of modern Indian investing.

Risks in Mutual Funds (Real, Not Fear-Based)

Every investment has risk.

Mutual funds are no exception.

But most people misunderstand risk.

Market Risk

Equity funds go up and down.

Short-term loss is normal.

Volatility Risk

Returns are not smooth.

Some years +30%, some years -10%.

Behaviour Risk (Biggest One)

People panic.

They stop SIP.

They redeem in loss.

This is the real risk, not the market.

Mutual funds fail only when:

Investor behaviour fails.

The Mutual Fund Reality Table

| Factor | Fixed Deposit | Mutual Funds |

|---|---|---|

| Returns | Low | Moderate to High |

| Inflation Protection | ❌ No | ✅ Yes |

| Risk | Very Low | Market-linked |

| Liquidity | Medium | High |

| Tax Efficiency | Poor | Better |

| Wealth Creation | Limited | Strong |

| Discipline | Manual | Automatic (SIP) |

This table shows one clear truth:

FD protects money.

Mutual funds grow money.

Important line after table:

This is why most long-term financial goals in India today are achieved using mutual funds, not traditional savings products.

Direct vs Regular Mutual Funds

This is where most investors make silent mistakes.

Direct Mutual Funds

- Bought through apps or websites

- Lower expense ratio

- No advisor support

Regular Mutual Funds

- Bought through distributor/advisor

- Slightly higher expense ratio

- Proper guidance + portfolio planning

Now the uncomfortable truth:

Direct is cheaper, but wrong fund selection is more expensive than any commission.

Beginners usually:

- Choose funds based on returns

- Ignore risk profile

- Over-diversify

- Create random portfolios

And later say:

“Mutual funds didn’t work for me.”

Reality:

Mutual funds worked, your strategy didn’t.

For new investors, regular plans with proper guidance beat direct plans without knowledge.

Mutual Fund Taxation in India

Equity Mutual Funds

- Short Term (less than 1 year): 20% tax

- Long Term (more than 1 year): 12.5% tax above ₹1.25 lakh

Debt Mutual Funds

Taxed as per income slab.

ELSS

- Tax saving under Section 80C

- 3-year lock-in

- Equity taxation applies

Mutual funds are far more tax-efficient than FDs.

For detailed tax rules including LTCG, STCG rates, and calculation examples, read our complete Mutual Fund Taxation Guide 2025-26.

Common Mistakes Indian Investors Make

These mistakes destroy more wealth than market crashes.

1. Chasing Past Returns

Last year’s top fund ≠ next year’s top fund.

2. Too Many Funds

10 funds in portfolio = confusion, not diversification.

3. Panic Selling

Market falls → people redeem → loss becomes permanent.

4. No Goal Planning

Investing without purpose = no direction.

5. Blind Direct Plans

No guidance + complex products = bad results.

Advanced Concepts (For Serious Investors)

SWP (Systematic Withdrawal Plan)

Used for:

- Monthly income

- Retirement

- Passive cash flow

STP (Systematic Transfer Plan)

Used to:

- Gradually move money from debt to equity.

Rebalancing

Adjusting portfolio every year based on:

- Market movement

- Risk level

- Financial goals

These concepts turn mutual funds from investment into a financial system

FAQ

Are Mutual Funds safe in India?

Yes, mutual funds are safe in India as an investment structure because they are regulated by SEBI. However, mutual funds are market-linked, so returns are not guaranteed. Safety depends on your time horizon, fund selection, and how long you stay invested.

How much should I invest in Mutual Funds every month?

There is no fixed rule. You can start with as low as ₹500 per month through SIP. The right amount depends on your income, expenses, and financial goals. The most important thing is not the amount, but consistency and long-term discipline.

Is SIP better than lump sum in Mutual Funds?

For most Indian investors, SIP is better than lump sum because it builds discipline, reduces market timing risk, and averages investment cost. Lump sum works well only when you have surplus money and a long-term horizon.

How many Mutual Funds should I have in my portfolio?

Ideally, 3 to 5 well-chosen mutual funds are enough for most investors. Having too many funds creates confusion and overlapping portfolios without improving returns.

Can I lose money in Mutual Funds?

Yes, you can lose money in the short term because mutual funds are market-linked. But long-term investors who stay disciplined usually generate positive returns and beat inflation over time. Losses mostly happen due to panic selling and wrong fund selection.

Final Expert Advice (The Real Conclusion)

Here is the truth most people won’t tell you:

Mutual funds don’t make people rich.

Consistency makes people rich.

The people who succeed with mutual funds:

- Start early

- Invest regularly

- Ignore noise

- Stay disciplined

- Think long-term

Mutual funds are not about intelligence.

They are about patience and behaviour.

If you treat mutual funds like a shortcut, you will fail.

If you treat mutual funds like a system, you will win.

Disclaimer

This article is for educational purposes only. Mutual fund investments are subject to market risks. Past performance does not guarantee future returns. Investors should evaluate their financial goals and risk profile before investing, and consult a qualified financial advisor if needed.

You don’t need perfect timing, perfect knowledge, or perfect funds.

You only need one perfect habit — staying invested in mutual funds.

6 thoughts on “Mutual Funds in India: The Complete Practical Guide”